Blockchain Technology: An Overview of Blockchain Networks

Blockchain is a distributed, digital ledger that records transactions in a secure, transparent, and immutable way.

At its simplest, blockchain is a distributed digital ledger that stores information across multiple computers in a way that ensures security, transparency, and immutability. The word itself combines “block” (a container of data) and “chain” (a linked list of blocks connected chronologically and cryptographically).

Unlike traditional centralized databases controlled by a single entity, blockchain operates in a decentralized network where every participant holds a copy of the ledger. Any new transaction must be validated by the network before it is added. Once recorded, data cannot easily be altered, which makes blockchain tamper-resistant.

- Distributed: Instead of a single server, data is stored across many computers (nodes) worldwide.

- Ledger: Like an accounting book, it records transactions (who sent what to whom).

- Immutable: Once data is added, it cannot be changed or deleted.

- Secure: Uses cryptography to protect data and verify participants.

Blockchain is a revolutionary technology that enables secure, transparent, and tamper-resistant digital transactions without the need for a central authority. Initially introduced in 2008 as the foundational technology behind Bitcoin, blockchain has evolved into a versatile framework underpinning diverse applications — from financial services and supply chains to healthcare and governance.

At its core, a blockchain is a distributed ledger that records data in chronologically linked “blocks”, which are validated and stored across a network of computers (nodes). This decentralized architecture ensures trustless collaboration, meaning participants can transact directly without intermediaries while maintaining data integrity.

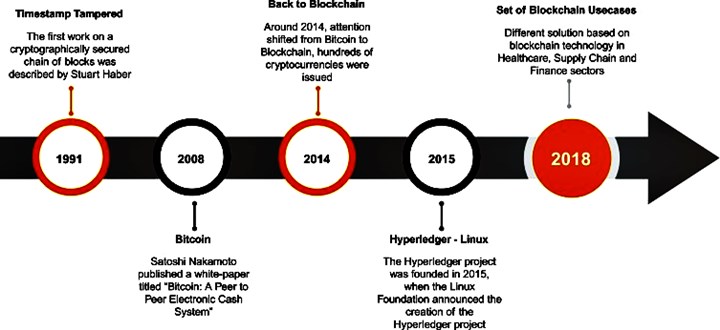

A Brief History of Blockchain

- 1991: Stuart Haber and W. Scott Stornetta first introduced the idea of a cryptographically secure chain of blocks. Their system aimed to timestamp digital documents to prevent backdating.

- 2008: Satoshi Nakamoto (a pseudonymous person or group) published the Bitcoin whitepaper, introducing blockchain as the backbone of Bitcoin — the first decentralized cryptocurrency.

- 2009: The Bitcoin network was launched, marking the first real-world implementation of blockchain.

- 2015: Ethereum expanded blockchain’s utility by introducing smart contracts, allowing programmable transactions beyond cryptocurrencies.

- 2018–present: Blockchain adoption spread into finance, logistics, healthcare, and even government systems, becoming one of the most discussed emerging technologies.

Historical Background

The conceptual foundation of blockchain can be traced to the 1990s with research on cryptographic timestamping and digital ledgers. However, it was Satoshi Nakamoto’s 2008 white paper, “Bitcoin: A Peer-to-Peer Electronic Cash System,” that marked the first successful implementation.

Bitcoin solved the double-spending problem — the risk that digital money could be copied and reused — through a decentralized network of validators using a consensus mechanism (Proof of Work). This breakthrough demonstrated that trust could be established mathematically and algorithmically, without relying on central banks or financial institutions.

Blockchain represents a paradigm shift in how data, value, and trust are managed in the digital era. Its decentralized architecture fosters transparency, resilience, and automation across industries. While challenges related to scalability, regulation, and sustainability remain, the technology continues to mature — paving the way for a more open, secure, and efficient digital economy.

Core Architecture of Blockchain

Structure of a Block

Each block in the blockchain consists of three primary components:

- Header: Contains metadata, including the hash of the previous block, a timestamp, and a nonce (used for proof of work).

- Transaction Data: A list of validated transactions.

- Hash: A unique cryptographic fingerprint of the block’s contents.

The cryptographic hash links each block to its predecessor, forming an immutable chain. Altering one block would require recalculating all subsequent hashes — an infeasible task on a large network.

The Distributed Ledger

A blockchain’s ledger is replicated across multiple nodes in the network. Each node maintains a complete copy of the ledger and participates in validating new transactions. Because the ledger is decentralized, there is no single point of failure, and manipulation would require compromising a majority of nodes simultaneously.

Consensus Mechanisms

Consensus algorithms ensure that all nodes agree on the validity of transactions. Common mechanisms include:

- Proof of Work (PoW):

- Miners compete to solve cryptographic puzzles.

- The first to solve adds the new block to the chain and is rewarded (used in Bitcoin).

- Ensures security but is energy-intensive.

- Proof of Stake (PoS):

- Validators are chosen based on the number of tokens they hold and “stake.”

- More energy-efficient (used in Ethereum 2.0, Cardano, and Solana).

- Delegated Proof of Stake (DPoS):

- Stakeholders vote for a limited number of trusted validators.

- Faster and more scalable (used in EOS, Tron).

- Byzantine Fault Tolerance (BFT) and Variants:

- Used in permissioned blockchains (e.g., Hyperledger Fabric).

- Ensures consensus even if some nodes act maliciously.

Transaction Lifecycle

- Transaction Creation: A user initiates a transaction (e.g., transferring tokens).

- Broadcasting: The transaction is shared across the network.

- Validation: Nodes verify transaction details and signatures.

- Block Formation: Valid transactions are grouped into a block.

- Consensus: Nodes agree on the validity of the block.

- Block Addition: The block is appended to the existing chain.

- Ledger Update: All nodes update their local copies.

This process ensures immutability, as each block’s hash depends on the previous one. Tampering with a past record would require re-mining every subsequent block — a computationally prohibitive task.

Smart Contracts

Smart contracts are self-executing digital agreements with terms directly written in code. Deployed on blockchain platforms like Ethereum, they automatically enforce rules when predefined conditions are met.

Example:

A smart contract could automatically transfer ownership of a digital asset once payment is received, without requiring intermediaries. This feature enables Decentralized Applications (DApps), Decentralized Finance (DeFi), and NFTs (Non-Fungible Tokens).

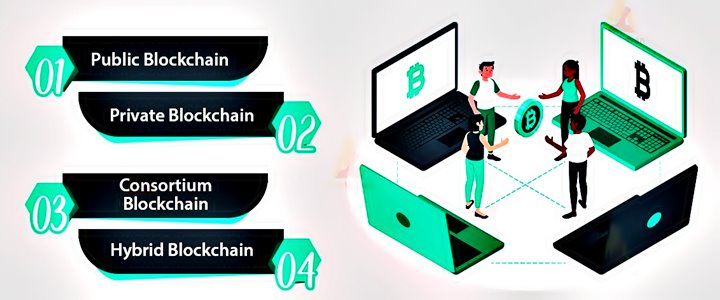

Types of Blockchains

- Public Blockchains:

- Open to anyone (e.g., Bitcoin, Ethereum).

- Fully decentralized but slower and less private.

- Private Blockchains:

- Access restricted to specific participants (e.g., Hyperledger Fabric).

- Greater privacy and control, used in enterprise environments.

- Consortium Blockchains:

- Governed by a group of organizations.

- Balance between decentralization and efficiency.

- Hybrid Blockchains:

- Combine features of public and private networks.

- Allow selective transparency and data sharing.

Blockchain Networks

A blockchain network is the ecosystem where blockchain operates — a collection of nodes (computers) that follow the same rules to validate, store, and share data.

Types of Blockchain Networks

- Public Blockchain

- Open to anyone.

- Examples: Bitcoin, Ethereum.

- Fully decentralized, anyone can join and verify transactions.

- Private Blockchain

- Restricted access (invite-only).

- Controlled by a single organization.

- Example: Hyperledger Fabric.

- Consortium (Federated) Blockchain

- Semi-private, managed by a group of organizations.

- Example: R3 Corda, Energy Web Chain.

- Hybrid Blockchain

- Mix of public and private features.

- Example: Dragonchain.

How Blockchain Works

Blockchain works by organizing data into blocks that are linked (chained) together in chronological order.

- Transaction Initiation

- A user requests a transaction (e.g., sending cryptocurrency, recording supply chain data).

- Broadcast to Network

- The transaction is broadcasted to all nodes in the network.

- Validation

- Nodes (miners/validators) verify the transaction using consensus algorithms:

- Proof of Work (PoW): Solving cryptographic puzzles (Bitcoin).

- Proof of Stake (PoS): Validators are chosen based on staked coins (Ethereum 2.0, Cardano).

- Other mechanisms: Proof of Authority, Proof of History, etc.

- Nodes (miners/validators) verify the transaction using consensus algorithms:

- Block Creation

- Validated transactions are grouped into a block.

- Each block contains:

- A list of transactions.

- A timestamp.

- A cryptographic hash of the previous block.

- Block Linking (Chain)

- The new block is linked to the previous block via hashes → creating a chain.

- Immutability

- Once added, changing a block would require altering all subsequent blocks (practically impossible).

- Completion

- The transaction is now permanent, transparent, and visible to all participants.

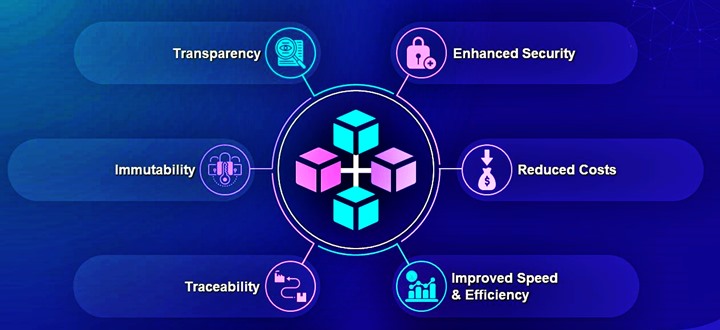

Advantages of Blockchain Technology

Decentralization

- Traditional systems rely on centralized authorities (banks, governments, corporations) to validate and record transactions.

- Blockchain eliminates this dependency by distributing control across a network of nodes (computers).

- This reduces the risk of single points of failure, censorship, or corruption.

Example: In Bitcoin, transactions are verified by thousands of miners worldwide, not a single bank or institution.

Transparency

- All transactions recorded on a public blockchain are visible to every participant.

- Anyone can verify transaction history, which promotes accountability and reduces fraud.

- Even in private or consortium blockchains, authorized participants can access verified records, ensuring trust between organizations.

Example: In supply chain systems, blockchain allows every participant — from manufacturer to retailer — to trace a product’s journey.

Immutability (Tamper Resistance)

- Once data is added to a blockchain, it cannot be changed or deleted without consensus from the network.

- This immutability ensures data integrity and long-term reliability of records.

- It also protects against malicious activity like double-spending or record manipulation.

Example: In land registry systems, property ownership recorded on blockchain cannot be secretly altered.

Enhanced Security

- Blockchain uses cryptographic hashing, digital signatures, and consensus algorithms to secure data.

- Transactions are encrypted and linked to previous blocks, making unauthorized changes nearly impossible.

- The decentralized structure means even if one node is compromised, the system as a whole remains secure.

Example: A hacker would need to control over 50% of the entire network (a “51% attack”) to alter the blockchain — which is computationally impractical on major networks.

Cost Reduction

- By removing intermediaries and manual verification steps, blockchain reduces transaction costs and administrative overhead.

- Smart contracts can automatically enforce agreements, eliminating the need for lawyers, brokers, or auditors in certain cases.

Example: International money transfers on blockchain can occur directly between users, avoiding high bank fees.

Faster Transactions and Efficiency

- Traditional banking or settlement systems can take days for cross-border transfers or contract validation.

- Blockchain networks operate 24/7, processing transactions in minutes or seconds, depending on the network.

- Automation via smart contracts increases operational efficiency and reduces human error.

Example: Ethereum-based smart contracts can instantly execute a loan or payment once predefined conditions are met.

Traceability and Provenance

- Every transaction on the blockchain is recorded chronologically, providing a permanent audit trail.

- This feature is especially valuable in supply chains, luxury goods, and food safety industries, where authenticity and origin tracking are essential.

Example: IBM’s Food Trust blockchain enables retailers and consumers to trace food products back to their source within seconds.

Improved Trust Among Participants

- Blockchain allows parties that don’t fully trust each other to collaborate safely.

- The shared, verified ledger ensures that all parties see the same truth, without relying on intermediaries.

- This fosters stronger business relationships, especially in multi-party ecosystems.

Automation via Smart Contracts

- Smart contracts are self-executing agreements coded into the blockchain.

- They automatically trigger outcomes when conditions are met, reducing delays, disputes, and paperwork.

Example: In insurance, a smart contract could automatically release payment when a flight cancellation is confirmed.

Accessibility and Financial Inclusion

- Blockchain networks are borderless and open, allowing anyone with internet access to participate.

- This helps unbanked or underbanked populations access financial services directly through decentralized finance (DeFi) platforms.

Example: People in developing countries can use blockchain-based wallets to store and transfer money without needing a traditional bank account.

| Advantage | Description | Example |

|---|---|---|

| Decentralization | Removes intermediaries and single points of failure | Bitcoin network |

| Transparency | Publicly visible and verifiable transactions | Supply chain tracking |

| Immutability | Data cannot be altered once recorded | Land registries |

| Security | Cryptographic and consensus-based protection | Digital identity systems |

| Cost Reduction | Eliminates intermediaries, lowers transaction fees | Cross-border payments |

| Speed & Efficiency | Faster settlements, automated processes | Smart contracts |

| Traceability | Provides end-to-end visibility of assets | Food provenance |

| Trust | Shared ledger ensures consistency between parties | Inter-company collaboration |

| Automation (Smart Contracts) | Self-executing code that enforces agreements | Insurance claims |

| Accessibility | Open participation for all internet users | DeFi wallets |

Disadvantages of Blockchain Technology

While blockchain offers transparency, security, and decentralization, it also faces significant limitations that affect scalability, efficiency, and adoption. These challenges vary depending on the type of blockchain (public, private, or consortium) and the specific use case.

Scalability Issues

- Problem: Public blockchains (like Bitcoin and Ethereum) can handle only a limited number of transactions per second (TPS) — far fewer than centralized systems like Visa or Mastercard.

- As every transaction must be verified by multiple nodes, throughput decreases as the network grows.

- This makes blockchain unsuitable for high-volume, real-time applications without additional scaling layers.

Example:

Bitcoin processes about 7 TPS, while Visa processes over 65,000 TPS at peak capacity.

High Energy Consumption

- Proof of Work (PoW) blockchains require enormous computational power to validate transactions.

- This leads to excessive electricity use, environmental impact, and hardware waste.

- Although newer systems (like Proof of Stake) reduce this issue, major networks like Bitcoin remain energy-intensive.

Example:

Bitcoin’s annual energy consumption has been compared to that of small countries such as Argentina or the Netherlands.

Storage and Data Size Limitations

- As blockchain grows, every node must store a complete copy of the ledger.

- This results in massive data accumulation, which can exceed hundreds of gigabytes.

- For smaller nodes or devices, maintaining a full blockchain copy becomes impractical, reducing network participation.

Lack of Privacy

- Public blockchains are transparent by design, meaning all transactions are visible to anyone.

- Although users are identified by pseudonymous addresses, with enough data analysis, identities can sometimes be traced.

- This is problematic for businesses and individuals requiring confidentiality.

Example:

Financial institutions may hesitate to use public blockchains due to the risk of exposing sensitive transaction details.

Regulatory and Legal Uncertainty

- Blockchain operates outside traditional legal frameworks, creating ambiguity in areas like taxation, ownership, and data protection.

- Many governments are still formulating policies for cryptocurrencies and blockchain applications.

- Unclear or inconsistent regulations slow down adoption and increase business risk.

Example:

Different countries have opposing stances — while some regulate or ban crypto, others actively promote blockchain innovation.

Irreversibility of Transactions

- Once a transaction is confirmed and added to the blockchain, it cannot be undone.

- This immutability, while an advantage for security, is a drawback when transactions are made in error or involve fraud.

- There’s no central authority to reverse mistakes or recover lost funds.

Example:

If you send cryptocurrency to the wrong address, the funds are permanently lost.

High Implementation and Maintenance Costs

- Setting up a blockchain infrastructure can be technically complex and costly.

- It requires skilled developers, hardware, and continuous maintenance.

- Enterprises often face integration challenges with existing systems and compliance requirements.

Example:

Private blockchains for supply chains may require multiple organizations to synchronize data formats, governance, and standards.

Latency and Network Speed

- Blockchain transactions go through multiple validation and consensus steps, which introduce delays.

- This can lead to slow confirmation times, especially when networks are congested.

Example:

Bitcoin transactions may take 10 minutes to several hours for confirmation during high traffic periods.

9. Limited Interoperability

- Many blockchain platforms (Bitcoin, Ethereum, Solana, Hyperledger, etc.) operate in isolation, using different protocols and standards.

- This makes data exchange and collaboration between different blockchains difficult, reducing usability across industries.

Example:

Assets on Ethereum cannot directly interact with those on Bitcoin without additional bridging solutions.

Risk of Centralization in Practice

- Although blockchain is theoretically decentralized, power can still become concentrated in practice:

- Mining power may be controlled by a few large pools.

- Proof of Stake systems favor those who already hold significant assets.

- This reduces fairness and can compromise network integrity.

Slow Adoption and Technical Complexity

- Many users and organizations lack understanding of blockchain’s technical workings.

- The learning curve and difficulty in integrating with traditional systems delay mass adoption.

- Issues such as key management (losing private keys = losing access forever) create usability barriers.

Potential for Misuse

- The anonymity and decentralization of blockchain can be exploited for illegal activities such as money laundering, ransomware payments, and black-market trading.

- This association harms blockchain’s public perception and regulatory acceptance.

| Disadvantage | Description | Example / Impact |

|---|---|---|

| Scalability | Limited transaction throughput | Bitcoin: 7 TPS vs Visa: 65,000 TPS |

| Energy Consumption | High power use in PoW systems | Bitcoin’s energy = small country |

| Storage Issues | Ever-growing ledger size burdens nodes | Hundreds of GB per node |

| Privacy Limitations | Public visibility of transactions | Identity deanonymization |

| Regulatory Uncertainty | Lack of global legal clarity | Varying crypto laws |

| Irreversibility | No way to undo wrong/fraudulent transactions | Lost crypto funds |

| High Costs | Expensive infrastructure and skilled labor required | Enterprise blockchain projects |

| Latency | Transaction delays under heavy load | Slow confirmations |

| Interoperability | Blockchains can’t easily communicate | Isolated ecosystems |

| Centralization Risks | Mining/staking power concentrated | Mining pools dominance |

| Adoption Barriers | Technical complexity and user inexperience | Low enterprise uptake |

| Misuse Potential | Enables illegal activities and dark web use | Crypto-based crimes |

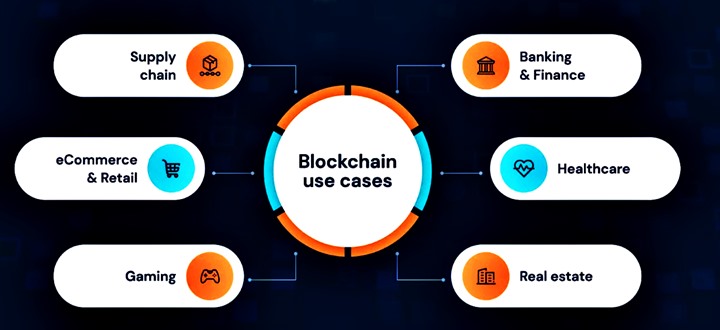

Use Cases of Blockchain

Blockchain applications extend far beyond cryptocurrencies:

- Finance and Banking

- Cross-border payments.

- Decentralized Finance (DeFi): loans, trading, yield farming.

- Supply Chain Management

- Track goods from origin to consumer.

- Improve transparency and reduce fraud.

- Healthcare

- Secure sharing of patient records.

- Ensure data integrity.

- Voting Systems

- Tamper-proof electronic voting.

- Increased transparency in elections.

- Identity Management

- Decentralized identity solutions for secure authentication.

- Real Estate

- Tokenization of property.

- Automated transactions through smart contracts.

- Digital Assets & NFTs

- Ownership of art, music, and collectibles verified on the blockchain.

Challenges and Limitations

Despite its potential, blockchain faces obstacles:

- Scalability

Public blockchains struggle to handle large transaction volumes quickly. - Energy Consumption

Proof of Work blockchains like Bitcoin consume massive amounts of energy. - Regulation

Governments are still developing legal frameworks for blockchain. - Privacy Concerns

While transparent, some industries require confidentiality. - Adoption Barriers

Integration with legacy systems can be complex and costly.

The Future of Blockchain

Blockchain is evolving rapidly. Potential future directions include:

- Central Bank Digital Currencies (CBDCs): Governments using blockchain to issue digital money.

- Interoperability: Cross-chain solutions allowing different blockchains to communicate.

- Layer 2 Solutions: Technologies like Lightning Network and rollups to improve scalability.

- Green Blockchains: Transition to energy-efficient consensus like PoS.

- Web3: A decentralized internet powered by blockchain and smart contracts.

Blockchain in Banking

Banking has always relied on trust, intermediaries, and centralized control to manage money, transactions, and records. However, traditional systems often suffer from delays, high costs, fraud risks, and lack of transparency.

Blockchain offers banks and financial institutions a way to streamline operations, improve security, and reduce reliance on intermediaries. By providing a decentralized, transparent, and tamper-proof ledger, blockchain has the potential to redefine the global banking ecosystem.

Why Blockchain Matters for Banking

- Traditional banking challenges:

- Slow cross-border transactions.

- High fees for international payments.

- Risk of fraud and cyberattacks.

- Centralized databases vulnerable to single points of failure.

- Complex compliance and regulatory processes.

- Blockchain advantages for banks:

- Instant settlement of transactions.

- Reduced costs by removing unnecessary intermediaries.

- Immutable records that prevent fraud.

- Real-time transparency for regulators and stakeholders.

- Smart contracts that automate compliance and financial agreements.

Applications of Blockchain in Banking

Payments and Cross-Border Transfers

- Traditional cross-border payments can take 3–5 days.

- Blockchain enables near-instant money transfers with lower fees.

- Example: Ripple (XRP) facilitates real-time international payments for banks.

Trade Finance

- Trade finance involves complex paperwork and intermediaries.

- Blockchain digitizes documents like letters of credit, bills of lading, and invoices, reducing fraud and delays.

- Example: HSBC and ING used blockchain for a live trade finance transaction in 2018, cutting processing time from 10 days to 24 hours.

Clearing and Settlement Systems

- Clearinghouses and intermediaries slow down settlement of trades.

- Blockchain provides real-time gross settlement (RTGS) without intermediaries.

- Reduces counterparty risks and operational costs.

Fraud Prevention and KYC/AML

- KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance requires banks to verify customers.

- Blockchain can create a shared, tamper-proof digital identity system, accessible across banks.

- Cuts down duplication, speeds up onboarding, and prevents fraud.

Syndicated Lending

- In syndicated loans, multiple banks lend to a borrower.

- Blockchain enables real-time updates, transparent records, and automated contract execution, reducing reconciliation issues.

Digital Currencies and Tokenization

- Central banks are exploring Central Bank Digital Currencies (CBDCs), issued and managed on blockchain.

- Tokenization of assets (bonds, shares, real estate) allows fractional ownership and easier trading.

Benefits of Blockchain in Banking

- Speed and Efficiency → Transactions that took days can now settle in minutes.

- Cost Reduction → Fewer intermediaries reduce transaction costs.

- Security → Cryptographic protection against fraud and hacking.

- Transparency → Regulators and banks can view real-time data.

- Financial Inclusion → Provides banking access to the unbanked population via mobile-based blockchain systems.

Challenges of Blockchain in Banking

- Regulatory Uncertainty → Different countries have conflicting regulations on blockchain and crypto.

- Scalability → Public blockchains face speed and volume limitations.

- Integration with Legacy Systems → Banks’ IT infrastructure is often outdated and hard to merge with blockchain.

- Privacy Concerns → Transparency may conflict with confidentiality required in banking.

- Energy Consumption → Some consensus mechanisms (like Proof of Work) are energy-intensive.

Real-World Examples

- RippleNet (XRP): Used by banks like Santander and Standard Chartered for cross-border payments.

- JPMorgan Chase – JPM Coin: A blockchain-based digital coin for instant settlements.

- HSBC & ING: Used blockchain in trade finance to cut transaction times significantly.

- Bank of America & Citi: Filed patents for blockchain-based solutions in banking.

- Central Bank Digital Currencies (CBDCs): China’s Digital Yuan and projects by the European Central Bank and U.S. Federal Reserve.

The Future of Blockchain in Banking

- Mainstream adoption: Within the next decade, blockchain could underpin much of global banking infrastructure.

- CBDCs: Likely to replace or complement cash in many countries.

- Interoperability: Banks will adopt multi-chain solutions for better integration.

- AI + Blockchain: Smart compliance systems powered by AI and blockchain could revolutionize fraud detection.

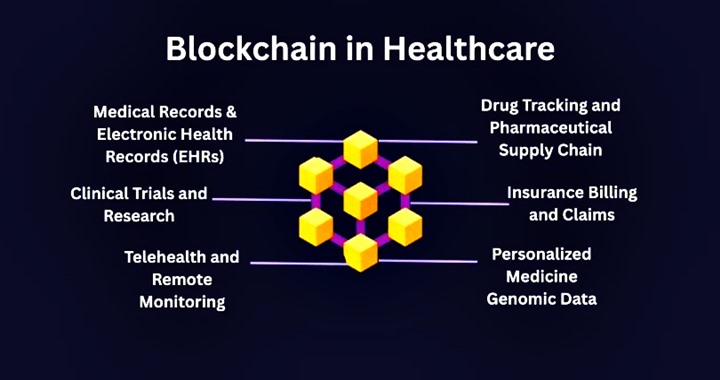

Blockchain in Healthcare

Healthcare is one of the most data-intensive and sensitive industries in the world. From electronic health records (EHRs) and insurance claims to clinical trials and pharmaceutical supply chains, vast amounts of information need to be stored, accessed, and shared securely.

Traditional healthcare systems often struggle with fragmented records, data silos, inefficiency, fraud, and lack of interoperability. Blockchain technology has emerged as a powerful solution that can transform how healthcare data is managed, ensuring security, transparency, interoperability, and patient-centric control.

Why Blockchain in Healthcare?

Current healthcare challenges that blockchain can address:

- Data fragmentation: Patient data is often scattered across hospitals, labs, insurers, and government agencies.

- Security risks: Healthcare records are frequent targets of cyberattacks.

- Fraud: Insurance fraud and counterfeit drugs cost billions annually.

- Lack of transparency: Patients often lack control over their own medical data.

- Interoperability issues: Different systems and standards make it difficult to share medical information.

Blockchain offers solutions through immutable ledgers, decentralized storage, and cryptographic security.

Applications of Blockchain in Healthcare

Secure Patient Data Management

- Patient data stored on blockchain is encrypted and tamper-proof.

- Patients can control who accesses their medical records through private keys.

- Eliminates the need for centralized databases vulnerable to hacking.

- Example: MedRec (MIT project) explores blockchain-based medical record sharing.

Electronic Health Records (EHRs)

- Today, EHRs are fragmented across different providers.

- Blockchain creates a unified and interoperable system where records are linked securely and accessible in real-time.

- Patients can grant or revoke access at any time.

- Reduces errors from incomplete or duplicated records.

Drug Supply Chain Management

- Counterfeit drugs are a $200 billion global problem.

- Blockchain enables end-to-end traceability of medicines from manufacturer to pharmacy.

- Ensures authenticity, reduces fraud, and helps during recalls.

- Example: IBM’s blockchain solution with the U.S. FDA for drug traceability.

Clinical Trials and Research

- Clinical trial data can be manipulated or hidden.

- Blockchain provides a transparent and immutable record of research data, ensuring credibility.

- Prevents falsification of results and promotes ethical medical research.

Insurance and Billing

- Medical billing fraud is a major issue.

- Smart contracts on blockchain can automatically verify insurance claims, reducing fraud and paperwork.

- Improves trust between insurers, hospitals, and patients.

Telemedicine and Remote Monitoring

- As healthcare shifts toward digital services, blockchain ensures secure sharing of telemedicine data.

- IoT devices (like smartwatches) can feed health data directly to blockchain for secure storage and analysis.

Benefits of Blockchain in Healthcare

- Data Security → Immutable and encrypted records prevent tampering.

- Patient Empowerment → Patients control who accesses their data.

- Transparency → Audit trails make healthcare systems accountable.

- Efficiency → Reduces administrative delays, fraud, and duplicate testing.

- Interoperability → Standardized blockchain systems enable data sharing across providers and regions.

- Cost Reduction → Streamlined operations cut down on administrative expenses.

Challenges of Blockchain in Healthcare

- Scalability → Storing massive healthcare data (like medical images) directly on blockchain is inefficient.

- Regulatory Barriers → Compliance with HIPAA, GDPR, and other privacy laws is complex.

- Integration → Legacy healthcare systems may resist adoption.

- Data Privacy vs. Transparency → Balancing openness with patient confidentiality is tricky.

- Cost of Implementation → High initial costs for hospitals and governments.

Real-World Examples

- MediLedger: Blockchain-based network to track prescription drugs in the U.S.

- BurstIQ: Provides blockchain-based secure health data exchange.

- Guardtime: Worked with Estonia’s eHealth Authority to secure patient records.

- Medicalchain: Allows patients to control access to their health records.

- IBM Watson Health + FDA: Pilot projects for blockchain in clinical trials and supply chain.

The Future of Blockchain in Healthcare

- Decentralized Health IDs: Patients will own portable, blockchain-based digital health identities.

- Global Health Records: Interoperable blockchain networks may unify health data worldwide.

- AI + Blockchain: Secure, decentralized datasets for training AI in healthcare diagnostics.

- Personalized Medicine: Combining blockchain and genomics for secure DNA-based healthcare.

- Public Health Monitoring: Governments could track outbreaks and vaccination campaigns transparently.

Blockchain in Countries: National Adoption and Impact

Blockchain is no longer just about cryptocurrencies — it has become a tool for governments, central banks, and national institutions to modernize operations, improve transparency, and fight corruption. Countries worldwide are exploring blockchain for digital currencies, identity systems, land registries, supply chain monitoring, voting, and e-governance.

The degree of adoption varies: some nations lead the way with national strategies and pilot projects, while others remain cautious due to regulatory, technical, or political challenges.

Why Countries Adopt Blockchain

Key motivations for governments:

- Transparency: Reduce corruption by making government records tamper-proof.

- Efficiency: Automate processes (land records, welfare distribution, licensing).

- Trust: Build citizen trust through open, verifiable systems.

- Financial Inclusion: Provide digital banking to the unbanked.

- Global Competitiveness: Stay ahead in the digital economy.

Blockchain Use Cases at the Country Level

Central Bank Digital Currencies (CBDCs)

- Many countries are experimenting with CBDCs — digital versions of their fiat currencies, built on blockchain.

- Benefits: faster payments, reduced costs, better monetary control.

- Example:

- China: Digital Yuan (e-CNY) is the most advanced CBDC project.

- Bahamas: Sand Dollar, launched in 2020, was the first fully deployed CBDC.

- Nigeria: eNaira, launched in 2021.

- European Union & USA: Still in research/testing phases.

E-Governance and Public Services

- Governments can use blockchain for secure, tamper-proof public records.

- Applications:

- Land and property registries → Prevent fraud and disputes.

- Digital identity systems → Secure citizen authentication.

- Licensing and permits → Transparent issuance processes.

- Example:

- Estonia: A global leader in blockchain-enabled e-governance. Uses blockchain for healthcare records, legal systems, and ID verification.

Voting Systems

- Blockchain-based voting ensures transparency and prevents fraud.

- Example:

- Sierra Leone (2018): Piloted blockchain voting in presidential elections.

- West Virginia, USA: Tested blockchain voting for overseas military personnel.

Supply Chain and Trade

- Governments use blockchain to track imports, exports, and logistics.

- Applications in food safety, customs, and energy tracking.

- Example:

- Dubai (UAE): Using blockchain for customs and logistics under its “Blockchain Strategy 2021.”

Healthcare and Welfare Distribution

- Governments can use blockchain to distribute welfare funds, track subsidies, and secure health data.

- Example:

- India: Exploring blockchain in drug supply chains to combat counterfeit medicines.

- UK NHS: Testing blockchain for health data sharing.

Benefits for Countries

- Reduced Corruption: Immutable records make bribery and fraud harder.

- Efficiency: Cuts bureaucracy and paperwork.

- Financial Inclusion: Digital wallets and CBDCs for unbanked citizens.

- Better Governance: Transparent policies, contracts, and welfare distribution.

- Stronger Economies: Encourages fintech, startups, and global investment.

Challenges for Countries

- Regulatory Complexity: Different interpretations of crypto and blockchain.

- Cybersecurity Risks: Blockchain is secure, but surrounding systems can be hacked.

- Privacy Concerns: Balancing transparency with citizens’ right to privacy.

- Scalability: National-level blockchain systems require huge processing power.

- Resistance to Change: Bureaucracies and legacy systems may block adoption.

Country-Specific Examples

- Estonia: Pioneer in blockchain governance; uses it for identity, healthcare, judiciary.

- China: Pushing blockchain heavily for digital yuan, supply chains, and government tracking.

- United Arab Emirates (UAE): “Dubai Blockchain Strategy” to move all government transactions to blockchain.

- India: Testing blockchain for land registries, agriculture, and drug supply chains.

- USA: Focused on private sector innovation; federal agencies testing blockchain in defense, health, and voting.

- Sweden: Tested blockchain-based land registry (Lantmäteriet).

- Brazil: Exploring blockchain in voting and identity systems.

Future of Blockchain in Countries

- More CBDCs: Within the next decade, most countries will have a national digital currency.

- Blockchain-powered governance: Tax collection, welfare, and licensing may all move to blockchain.

- Cross-border trade: Nations will use blockchain for customs, shipping, and international payments.

- Digital identity & citizenship: A blockchain-based “global ID” may emerge.

- Smart cities: Governments may integrate blockchain into urban infrastructure and IoT.

Blockchain in Bangladesh

Bangladesh, a fast-growing South Asian economy, is gradually exploring blockchain technology. While not yet fully mainstream, blockchain has attracted the attention of government agencies, financial institutions, and the ICT sector.

Blockchain is seen as a tool to improve financial inclusion, secure supply chains, enhance governance, and support innovation. However, adoption is still at an early stage compared to countries like China, UAE, or Estonia.

Why Blockchain Matters for Bangladesh

Bangladesh faces challenges that blockchain could help solve:

- Banking inefficiency → Slow, expensive cross-border remittances.

- Corruption and transparency issues → Immutable blockchain records could reduce fraud.

- Supply chain monitoring → Particularly important in garments, pharmaceuticals, and agriculture.

- Digital identity gaps → Blockchain could strengthen e-governance.

- Financial inclusion → Millions remain unbanked but own mobile phones.

Current Adoption of Blockchain in Bangladesh

Government Initiatives

- Bangladesh Government Blockchain Strategy (under ICT Division): Early-stage efforts to explore blockchain for governance and financial systems.

- Bangladesh Bank (central bank): Studying blockchain for trade finance, remittances, and cross-border payments.

Financial Services

- Banks: A few banks in Bangladesh have joined blockchain-based international trade networks like Contour for letter of credit (LC) settlements.

- Remittances: Since Bangladesh is one of the top remittance-receiving countries in the world, blockchain solutions are being explored to reduce transaction costs and time.

Supply Chain and Trade

- Garment Industry: Blockchain can improve transparency in the ready-made garment (RMG) sector by tracking materials from production to export.

- Pharmaceuticals: Helps combat counterfeit drugs by enabling traceability.

- Agriculture: Ensures transparency in food supply chains and exports.

Education and Research

- Universities and ICT training institutes are conducting research and skill development programs on blockchain to prepare for future adoption.

Potential Use Cases for Bangladesh

- Remittances → Blockchain-based remittance systems could save billions in fees.

- Trade Finance → Faster and fraud-free processing of import/export documents.

- Land Records → Digitizing and securing land registries to prevent disputes and corruption.

- Identity Management → Blockchain-backed digital IDs for citizens.

- Healthcare → Secure sharing of patient records across hospitals.

- Supply Chain Transparency → Especially for RMG, seafood, and agricultural exports.

- E-Governance → Transparent, tamper-proof systems for licenses, permits, and welfare distribution.

Benefits of Blockchain for Bangladesh

- Reduce corruption: Immutable government records.

- Improve global trade reputation: Transparent supply chains in garments and pharmaceuticals.

- Boost remittances: Lower costs for migrant workers sending money home.

- Support financial inclusion: Mobile-based blockchain banking for the unbanked.

- Build investor confidence: Transparent business environment.

Challenges in Bangladesh

- Regulatory Uncertainty → No comprehensive legal framework for blockchain/crypto.

- Ban on Cryptocurrency → Bangladesh Bank has banned cryptocurrency trading, slowing blockchain enthusiasm.

- Lack of Expertise → Limited local expertise in blockchain development.

- Infrastructure Gaps → Nationwide digital infrastructure still developing.

- Adoption Barriers → Traditional bureaucracy may resist transparent systems.

Future Outlook

- Government-led adoption is likely to start with e-governance, trade finance, and supply chain monitoring.

- CBDC (Central Bank Digital Currency): Bangladesh Bank may eventually explore a digital taka.

- Education and skills: Expanding blockchain training under ICT programs.

- Private sector adoption: RMG, pharmaceuticals, and agriculture exporters will push for blockchain to meet global compliance.

- Smart Bangladesh 2041: Blockchain could become a backbone for digital governance and smart cities.

Blockchain in the Stock Market

The global stock market handles trillions of dollars in daily trading volume, connecting investors, brokers, exchanges, clearinghouses, and regulators. While it is highly advanced, the system still suffers from delays, high costs, settlement risks, and lack of transparency.

Blockchain, with its decentralized ledger, real-time settlement, and smart contract capabilities, has the potential to transform stock markets by making trading more efficient, transparent, and secure.

Current Challenges in Stock Markets

- Settlement Delays

- Trades typically take T+2 days (2 business days) to settle.

- Counterparty and credit risks remain until settlement.

- High Costs

- Multiple intermediaries (brokers, clearinghouses, custodians) increase transaction costs.

- Lack of Transparency

- Opaque systems make it difficult to trace ownership in real time.

- Fraud and Manipulation

- Insider trading, false reporting, and “naked short selling” are hard to track.

- Limited Access

- Many investors globally face barriers to stock trading due to infrastructure or regulation.

How Blockchain Can Transform Stock Markets

Faster Settlement

- Blockchain enables real-time (T+0) settlement by directly recording ownership transfers on a shared ledger.

- Reduces counterparty risks and liquidity requirements.

Tokenization of Stocks

- Shares can be digitally represented as tokens on a blockchain.

- Enables fractional ownership, making investing more accessible.

Transparency & Traceability

- Every transaction is recorded on an immutable ledger.

- Regulators and investors get real-time auditability.

Smart Contracts

- Automate compliance, dividend distribution, and corporate actions.

- Reduces paperwork and errors.

24/7 Global Access

- Blockchain-based exchanges can run 24/7 instead of traditional market hours.

- Increases participation and liquidity.

Benefits of Blockchain in Stock Markets

- Efficiency → Faster and cheaper trades by reducing intermediaries.

- Security → Tamper-proof records prevent fraud.

- Transparency → Real-time monitoring for regulators and investors.

- Liquidity → Tokenization enables trading of smaller shares and fractional assets.

- Financial Inclusion → Wider global access to capital markets.

Challenges of Using Blockchain in Stock Markets

- Regulation → Securities laws vary across countries, creating compliance complexity.

- Scalability → Handling billions of trades per day requires high-speed blockchains.

- Privacy → Public blockchains may expose sensitive investor data.

- Transition Barriers → Integrating blockchain with legacy trading systems is costly and complex.

- Resistance from Intermediaries → Brokers, clearinghouses, and custodians may resist disruption.

Real-World Examples

- NASDAQ (USA): Using blockchain for private market share trading through its platform NASDAQ Linq.

- Australian Securities Exchange (ASX): Replacing its CHESS settlement system with a blockchain-based platform (though facing delays).

- Swiss SIX Exchange: Launched SIX Digital Exchange (SDX), a blockchain-based platform for digital assets.

- London Stock Exchange (LSE): Exploring blockchain for tokenized securities.

- tZERO (by Overstock): A blockchain-powered trading platform for tokenized stocks and assets.

The Future of Stock Markets with Blockchain

- Tokenized Securities: Almost all stocks may be represented as tokens in the future.

- Decentralized Exchanges (DEXs): Traditional exchanges may adopt hybrid blockchain systems for regulated trading.

- CBDCs Integration: Settlement could be done instantly using central bank digital currencies.

- Global Markets: Blockchain could connect exchanges across borders, enabling seamless global trading.

- AI + Blockchain: Artificial intelligence could analyze blockchain trading data for fraud detection and market insights.

In conclusion, blockchain technology represents a transformative approach to storing, sharing, and verifying data in a secure, transparent, and decentralized manner. By removing the need for central intermediaries, blockchain networks enhance trust, reduce transaction costs, and improve efficiency across industries. Whether applied in finance, supply chains, healthcare, or governance, blockchain’s distributed ledger and cryptographic integrity offer a foundation for innovation and accountability. As the technology continues to evolve, the growth of interoperable and scalable blockchain networks will play a vital role in shaping the future of digital trust and decentralized ecosystems.

However, challenges remain — including scalability limitations, high energy consumption in some consensus mechanisms, regulatory uncertainty, and the need for standardization across platforms. Addressing these issues will be critical for the widespread adoption and integration of blockchain technology.

Ultimately, blockchain and its networked ecosystems represent a foundational layer for the next generation of the digital economy — one where trust is established through mathematics and consensus rather than centralized institutions. As research and innovation continue, blockchain networks are poised to become a cornerstone of secure digital infrastructure, reshaping global systems of value exchange, governance, and data integrity for decades to come.

Writer: Tahsin Ahmed